Financial scandals have hit the news several times in recent history. Looking at these stories offers a great way to learn some tough lessons and how we can improve our everyday practices as finance professionals.

As accountants, our main goal is to help keep businesses financially healthy. By observing the mistakes that others have made, and more importantly how to avoid them, we can be better prepared to face the challenges of the accounting industry.

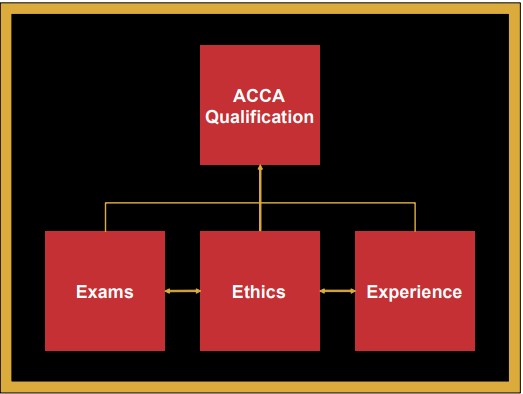

So that’s why to make ethical accountants ACCA has recently emphasized more on the New Ethics Module. The Ethics and Professional Skills module (EPSM) is an essential part of the ACCA Qualification and helps increase your employability and workplace effectiveness. The module uses realistic business simulations to develop a number of professional skills such as leadership, communication and commercial awareness.

To get ACCA Membership an individual need to complete three core components (EEE). The Exams, Ethics and Experience

Here are the Four worst corporate accounting scandals and what we can learn from each of them.

- ENRON SCANDAL (2001)

Company: Houston-based commodities, energy and Service Corporation

What happened: Shareholders lost $74 billion, thousands of employees and investors lost their retirement accounts, and many employees lost their jobs.

Main players: CEO Jeff Skilling and former CEO Ken Lay.

How they did it: Kept huge debts off balance sheets.

How they got caught: Turned in by internal whistleblower Sherron Watkins; high stock prices fuelled external suspicions.

Penalties: Lay died before serving time; Skilling got 24 years in prison. The company filed for bankruptcy. Arthur Andersen was found guilty of fudging Enron’s accounts.

Fun fact: Fortune Magazine named Enron “America’s Most Innovative Company” 6 years in a row prior to the scandal.

- WORLDCOM SCANDAL (2002)

Company: Telecommunications Company; now MCI, Inc.

What happened: Inflated assets by as much as $11 billion, leading to 30,000 lost jobs and $180 billion in losses for investors?

Main player: CEO Bernie Ebbers

How he did it: Underreported line costs by capitalizing rather than expensing and inflated revenues with fake accounting entries.

How he got caught: WorldCom’s internal auditing department uncovered $3.8 billion of fraud.

Penalties: CFO was fired, controller resigned, and the company filed for bankruptcy. Ebbers sentenced to 25 years for fraud, conspiracy and filing false documents with regulators.

Fun fact: Within weeks of the scandal, Congress passed the Sarbanes-Oxley Act, introducing the most sweeping set of new business regulations since the 1930s.

- LEHMAN BROTHERS SCANDAL (2008)

Company: Global financial services firm.

What happened: Hid over $50 billion in loans disguised as sales.

Main players: Lehman executives and the company’s auditors, Ernst & Young.

How they did it: Allegedly sold toxic assets to Cayman Island banks with the understanding that they would be bought back eventually. Created the impression Lehman had $50 billion more cash and $50 billion less in toxic assets than it really did.

How they got caught: Went bankrupt.

Penalties: Forced into the largest bankruptcy in U.S. history. SEC didn’t prosecute due to lack of evidence.

Fun fact: In 2007 Lehman Brothers was ranked the #1 “Most Admired Securities Firm” by Fortune Magazine.

- SATYAM SCANDAL (2009)

Company: Indian IT services and back-office accounting firm.

What happened: Falsely boosted revenue by $1.5 billion?

Main player: Founder/Chairman Ramalinga Raju.

How he did it: Falsified revenues, margins and cash balances to the tune of 50 billion rupees.

How he got caught: Admitted the fraud in a letter to the company’s board of directors.

Penalties: Raju and his brother charged with breach of trust, conspiracy, cheating and falsification of records. Released after the Central Bureau of Investigation failed to file charges on time.

Fun fact: In 2011 Ramalinga Raju’s wife published a book of his existentialist, free-verse poetry